Everyone wants to know “how long does probate take?” The answer is simple. It depends. In most situations, if the estate has been opened less than six months after the decedent’s death, the probate court will not close the estate until six months has passed since the date of death. This is because creditors have […]

One of the estate planning considerations that is not discussed a lot is document storage. Where should you keep your estate planning documents? There are quite a few options on this front. But here are some things that you need to know… First, as a general rule, the Probate Court needs the original will. The […]

Sometimes an estate plan changes without somebody intending to change it. Here are a few places where this occurs. A couple purchases a new piece of real estate. Remember, what happens with a piece of real estate after the death of an owner is based on the ownership structure when the person buys the real […]

It’s important to understand what is going on with creditor bills. In Ohio, a most creditors have six months to submit a claim for payment. It’s important to emphasize the term “most” because there are a few notable exceptions. The IRS, Medicaid, and secured creditors (think mortgages) are not subject to these deadlines. Additionally, if […]

If you’re an executor, administrator, or trustee, and you have real estate to sell, you need to know about point of sale inspections. What are these inspections? Basically, a point of sale inspection is an inspection by the building department of a municipality to ensure that the property to be listed for sale meets certain […]

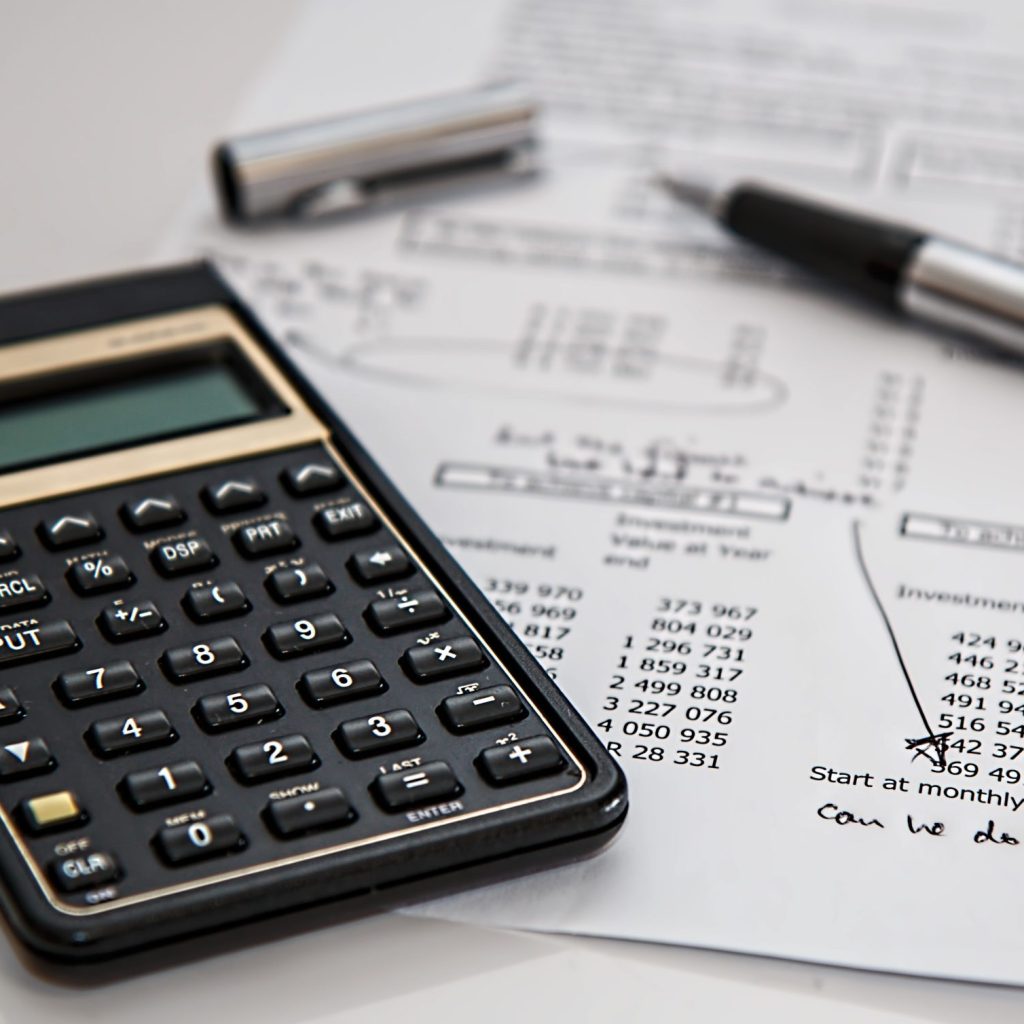

There are some important considerations when it comes to appraising the estate. An executor or administrator must return an inventory and appraisal to the Probate Court within three months of the appointment. But it’s important to consider how to do the appraisal. Ohio law permits an estate to use the county auditor’s value for real […]

Part of an effective estate plan includes thinking about insuring the estate. An executor expressly agrees to insure all estate assets. Here are some things to think about. If decedent died owing a vehicle and/or any real estate in their name alone, the estate will likely own these assets. They will need to be insured […]

What is the story with probate bond? What is it? When is it required? Quite simply. A bond is an insurance policy that the executor or administrator of the estate must purchase and file with the probate court to secure the value of personal property in the estate. The purpose of the bond is to […]

Insurance for estates can be tricky. The first thing you need to do is notify the decedent’s insurance agent right away that the decedent has passed. There are a number of reasons for this. If the decedent’s home was going to pass under a transfer on death designation affidavit then there is no coverage for […]

Do you understand your healthcare advance directives? What is the difference between the healthcare power of attorney and living will? How do the documents work together? The Healthcare Power of Attorney is a document that designates someone to make health care decisions for you if you are unable to do so. It also enables someone […]

Ohio does not have a standardized medical authorization form to allow parents to designate someone to make healthcare decisions for their children. However, it is quite likely that little Johnny or Suzie get injured while they are staying at Grandma’s house when mom and dad are traveling for work. This means that Grandma and Grandpa […]

Are you worried that a family member is going to be challenging the will? There is a short time frame to initiate a challenge. In Ohio, an action to contest a will must be filed within 90 days from the date that a Certificate of Service of Notice of Probate of Will is filed with […]

If anyone every asks about bank forms for POA, my advice is simple-sign them. If there’s one act that gives the bank employees pause, it’s when someone walks in with a Power of Attorney (POA). It’s understandable. When you sign a POA, you allow someone to be you for all of your financial affairs. The […]

If the decedent died owning a boat, the question becomes who’s taking the boat? It’s pretty much the same answer that I give to any legal question. It depends. Here’s the story. If there is a surviving spouse, that spouse may take (1) watercraft (it could be a boat, a kayak, or a jets […]

For the executor who is unprepared, banking matters can be a little overwhelming. Banks are highly regulated and there are a lot of requirements that their employees must follow. There are more rules for a trust or estate. This is because the bank doesn’t want to be sued if the executor or trustee steals money […]

The biggest challenge as an estate attorney might be maintaining trust among all of the beneficiaries through the probate administration. It’s understandable. Often, the probate administration leaves one sibling in charge. There might be some resentment about who was nominated as executor and why they were chosen. There might be some resentment because the executor […]

There are some additional considerations when planning for unmarried couples. While there are plenty of people who consider themselves happily unmarried, the laws of inheritance might not be so friendly yo these couples Here’s why… Someone who is legally married almost always inherits something from their late spouse. While it is possible for someone to […]

Sorting It Out Later is Not An Estate Plan. Here’s what I mean by that… Recently someone came to me to divide assets between the children of a deceased parent. The parent’s first desire was to avoid probate. The parent’s alleged plan was to leave everything to one child through joint ownership and beneficiary designations. […]

You really don’t want your business in probate. It’ll just be messy. There’s really no other way to put it. There are a few reasons for this. First, the delays of a probate administration will affect the business just like any other asset. But it may make things more difficult. You might not be ready […]

If there is a basic tip for clients it’s to streamline your estate plan. To often clients have so many financial assets that are spread out far and wide. When someone passes away, there is a pile of paper that everyone looks to make sense of. In probate court, the executor or administrator is going […]

Could you create your estate plan yourself? DIY? Sure. You could do that. But it’s not the same as going to the hardware store to do some DIY plumbing. If you need to change some plumbing in your house, you can put together some pipe, valves, and fittings. Then you can turn the water on […]

If there’s one asset in an estate that has a lot of sentimental attachment, it’s the family vacation home. That’s understandable. There were a lot of great memories made there. Part of the objective for the estate plan for the second home is to make sure that the family memories aren’t tarnished in a fight […]

If your sole goal is to avoid probate in your estate plan, I might tell you to be careful what you wish for. Based on stories that may have been blown out of proportion, it seems like everyone has a desire to stay away from probate. I think the better approach is to find out […]

There are a few things to consider before beginning probate. You want to gather as much information as possible before you start so that there are not delays later on. You will need to know the names and home addresses of all of the decedent’s children. You need this information regardless of whether these people […]

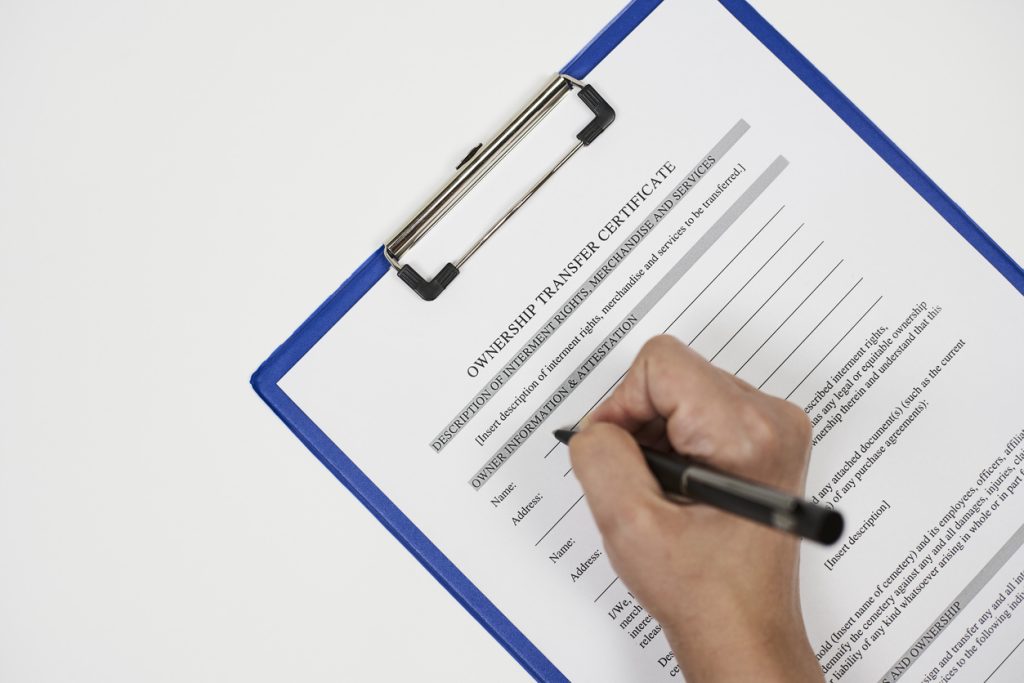

How does an estate administration factor in when you are working with real estate? The answer to this question differs based on whether or not there is a will and whether that will has a power to sell real estate. If there is a will, and the will gives the executor the power to sell […]

You may need to think about doing a clean up for your estate planning documents. What do I mean by that? Go find your estate planning documents. Do you have the originals? If not, you should secure them. There is an additional process to admit a copy of a will to probate. It typically involves […]

The executor’s responsibilities, at a basic level, include the following: If there is a will, the executor must give notice to all of the relatives that the will is being probated within two weeks after they are appointed. The family members can waive this notice. The executor must then file a certificate of notice with […]

There are a lot of offers out there to make online wills. I have even seen a few that come up on social media platforms. The thing about online wills is that the person making them doesn’t know what needs to be in these documents in order for them to work. As an attorney, I […]

Sometimes estate administrators fall victim to problems they didn’t even know about. Here’s a common one… After one spouse dies, the surviving spouse goes to sell a piece of real estate that they owned with the deceased spouse. The surviving spouse tells the realtor about the ownership situation. Realtor says, “No big deal. You’ll probably […]

I’m often asked, “Is a will really that advantageous?” Won’t everything go to my kids equally anyway? Let’s unpack the answers to these questions. First, having will enables works around a few scenarios. Without a will, an out of state resident cannot administer the estate of an Ohio resident. That’s right, if you’re not named […]

I have to admit I am almost always nervous to ask if there is a car as part of an estate. Cars can be a neglected aspect of estate planning because people often get a new car after they have updated their estate plan. Cars can have a short cycle of ownership. People often don’t […]

I often get asked about the ability to sell the house in probate. In an estate administration, a house can be an extra burden. There are expenses that come right away. The executor or administrator of an estate immediately has expense like utilities, real estate taxes, and insurance. There are also chores. The family not […]

Can you fast track a probate administration? Maybe. Every estate administration is different. If there is a surviving spouse there may be more options than if there is not a surviving spouse. To try to move an estate administration as quickly as possible, you’ll need to have account statements for the month that includes the decedent’s […]

Tasking a matter through probate court without an attorney just got harder. I don’t think it was ever easy. If you ask even the most experienced probate attorney, they probably have a matter that didn’t make it through the probate court without delays. I’ve been at the filing counter when someone asks about what is […]

Let’s take a look at another example where someone’s thought avoiding probate was the best solution in an estate plan. Let’s say that the desire to is to leave the family home equally to all three of their married adult children. Each child would own a one third interest and they can figure out what […]

Doesn’t everything go to my kids in equal shares? Why do I need an estate plan? Does everything go to your children? Maybe. Maybe not. When there is not a will, the inheritance is based on the family situation. So you can’t use assume that probate will work out the same way that it did […]

Will there have to be an appraisal of the estate assets? That depends on what property is in the estate. Three months after an executor or administrator is appointed in an estate, an estate inventory must be filed with the probate court to show which assets the estate is managing and the values of those […]

There is no requirement that you have to use the drafting attorney to probate the will. When I write drafting attorney, I mean the attorney that wrote the will or trust. The executor can hire the probate attorney of their choosing to administer an estate. There is not any requirement or obligation that an executor […]

An effort to avoid probate at all costs can go awry. There are so many people who say, “I don’t want any part of probate. I’ve heard all of the horror stories.” What is the main way that clients seek to avoid probate? Through the use of Transfer on Death Designation (TOD) Affidavits. These affidavits […]

You need to be careful if there is a vacant home that is part of an probate administration. There are a lot of risks with a vacant home because nobody is living there to keep an eye on things. Here is a list of important considerations. Always make sure that the insurance policy is current […]

There are some out of state considerations for estate planning and probate. Let’s dive into these. If the person you desire to have as your executor of your estate is not a resident of Ohio, then you must have a will to nominate that person as the executor. Under Ohio law, a non-resident of […]

Estate planning in divorce? A divorce is a very stressful time. People are always told to be sure to ask your attorney about this, and also about that. It can all be very confusing and overwhelming. You might not even consider that you may need to update your estate planning documents as you are headed […]

Is probate really that bad? Let’s unpack this question. I have met a lot of clients who say, “We definitely want to avoid probate. That’s just too time consuming and expensive.” This is not really the entire story. This is why estate planning is not a “one size fits all” process. There is still an […]

Have you thought about estate planning for your car? If not, you probably should. Ohio law allows you to designate a Transfer on Death Beneficiary (TOD) on an automobile title. This is just like a beneficiary on a bank account. The beneficiary can be a person, a trust, or a business entity. After the death […]

It’s summer after all. It’s time for some new memories to be made at the family vacation homes. The vacation home is one of those assets that really needs some special consideration. Usually there is a desire to keep this home in the family. There is a lot sentimental attachment to a vacation home. If […]

Transfer on Death Designation Affidavits are very popular estate planning tools. The basic idea is simple. When a person dies owning real estate, the deceased owner can name a person to inherit the real estate after the current owner’s death. No probate required for this asset in most situations. Sounds like a great idea. Why […]

Choosing the executor should not be an overlooked aspect of the estate planning process. I prefer clients that clients have made this decision before they meet with me. Here are some considerations that you can consider when deciding who should serve as executor. These are certainly not the only considerations. Some people will automatically chose […]

What should you do to get organized for estate planning? Make a list of all of your accounts and account numbers. This includes checking, savings, retirement, and brokerage accounts. You should also include insurance policies and policy numbers (auto, homeowner’s, and life insurance) on this list. If something happens to you, you will want to […]

Retirement accounts do not always get much attention when clients are estate planning. It’s easy to think, “Well, I’ll talk to my financial advisor and make sure that she has the names of all of my beneficiaries.” This is not the only consideration. You also need to plan for the tax associated with distributions from […]

Did you take title to your home with a survivorship deed? The first place to look to determine the future ownership of real estate is with the county Recorder’s office. If two or more people own real property with a survivorship deed (also called Joint Tenants With Right of Survivorship), the property passes to the […]

Retirement accounts are often a large part of someone’s estate. It is extremely important to plan who will inherit these accounts. Even without the changes to the law in 2020, you should review your beneficiaries. This is true for real estate, bank accounts, brokerage accounts, retirement accounts, automobiles, and any other asset that has transfer […]

When planning for a blended families, it is important to keep a few things in mind. In Ohio, a surviving spouse has certain rights at the death of their spouse. These rights include the ability to take certain vehicles outside of probate, a superior right to administer an estate if the deceased spouse did not […]

There can be gaps in insurance coverage for the deceased owner’s property after the death of the insured owner. The homeowner’s insurance coverage is the most notable place to be on alert. The analysis is different based on how the owner had the property titled. Here are a couple variations of what could happen with […]

Real Estate is distributed upon the death of the owner based on how it was titled. This means if two people buy a home as Joint Tenants With Right Of Survivorship and one dies, the home automatically goes to the other owner. This happens regardless of what the deceased owner’s will says. In many blended […]

Probate is a court managed process that reviews the validity of a Will and oversees the distribution of assets to beneficiaries. If a person does not have a Will, then the assets are transferred to family members under a process outlined by state law. Because there is a lot of paperwork involved, this process can […]

A Health Care Power of Attorney designates someone to make health care decisions for you do not have the capacity to make those decisions yourself. A Health Care Power of Attorney is only useful if your representative or agent has it or knows where to find it. It is best to give your Health Care […]

Many people today rarely go to the bank. We live in a world of cashless transactions. If you haven’t seen your banker in a while, you should make an appointment to review the beneficiary designations on your accounts. Beneficiary designations allow to choose someone to receive the funds in your account upon your death. These […]

Many seniors executed a Will many years ago. While this original document is likely still valid, it is important to update a Will after any major life change. Most people should review their current estate planning documents after getting married or divorced, buying or selling a home, inheriting substantial assets, and other significant life changes. […]